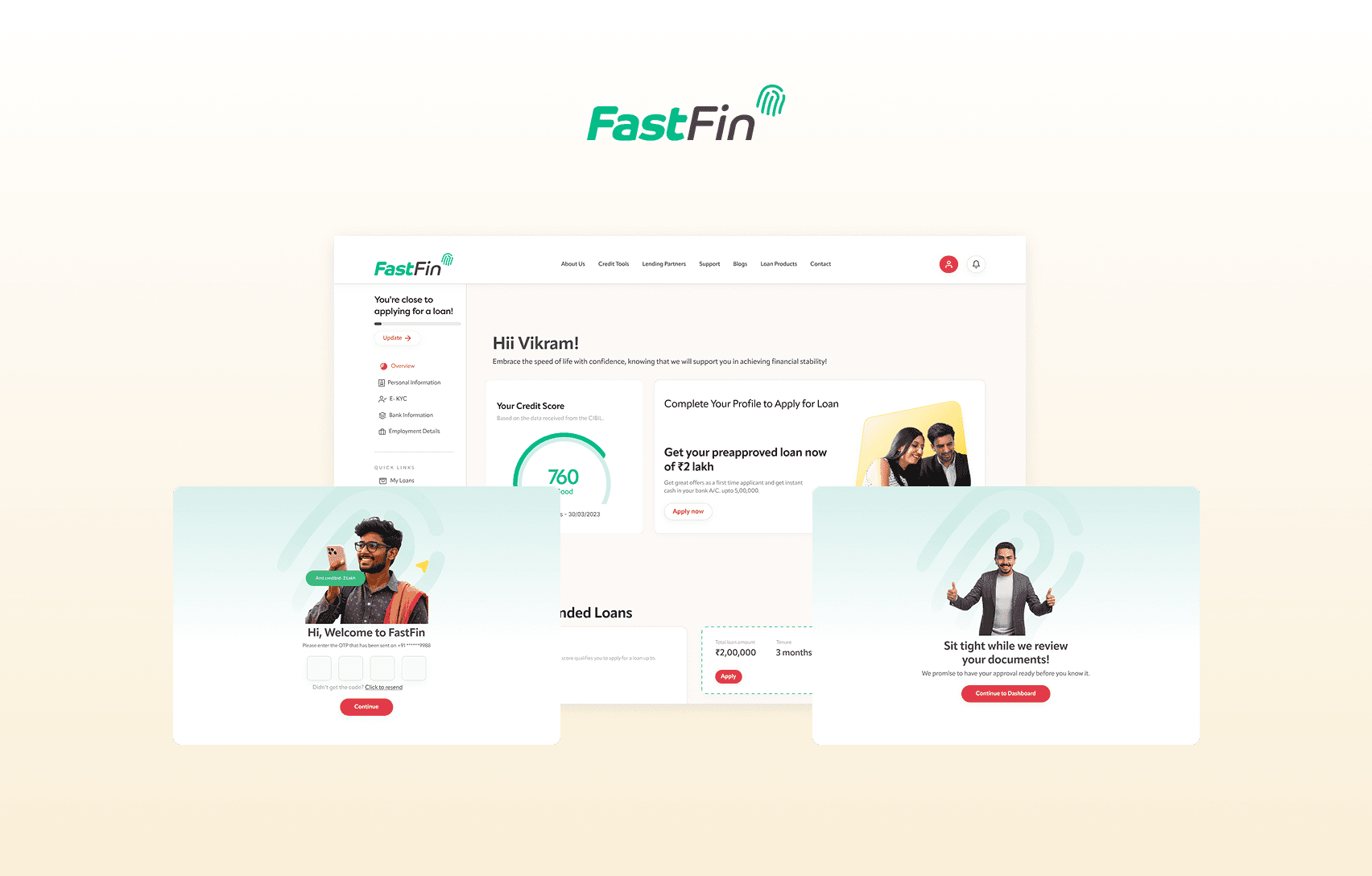

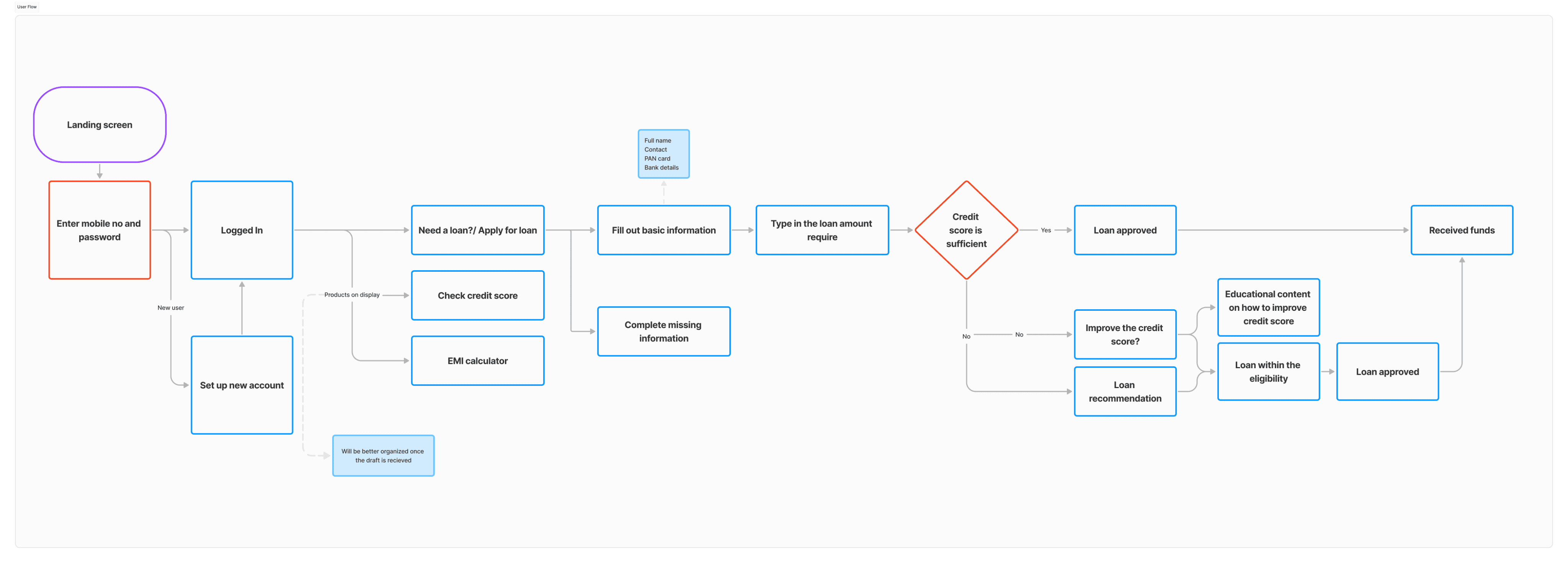

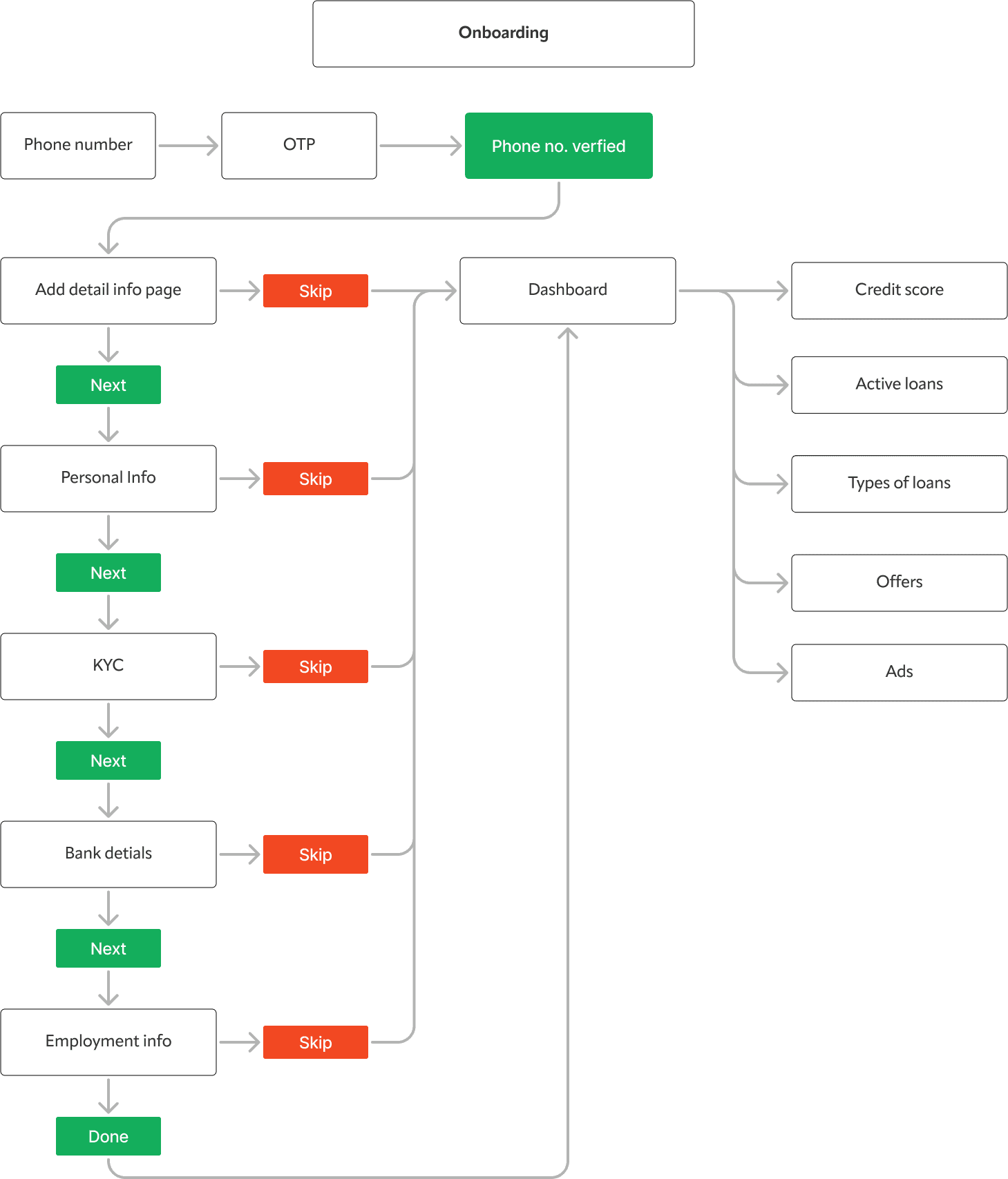

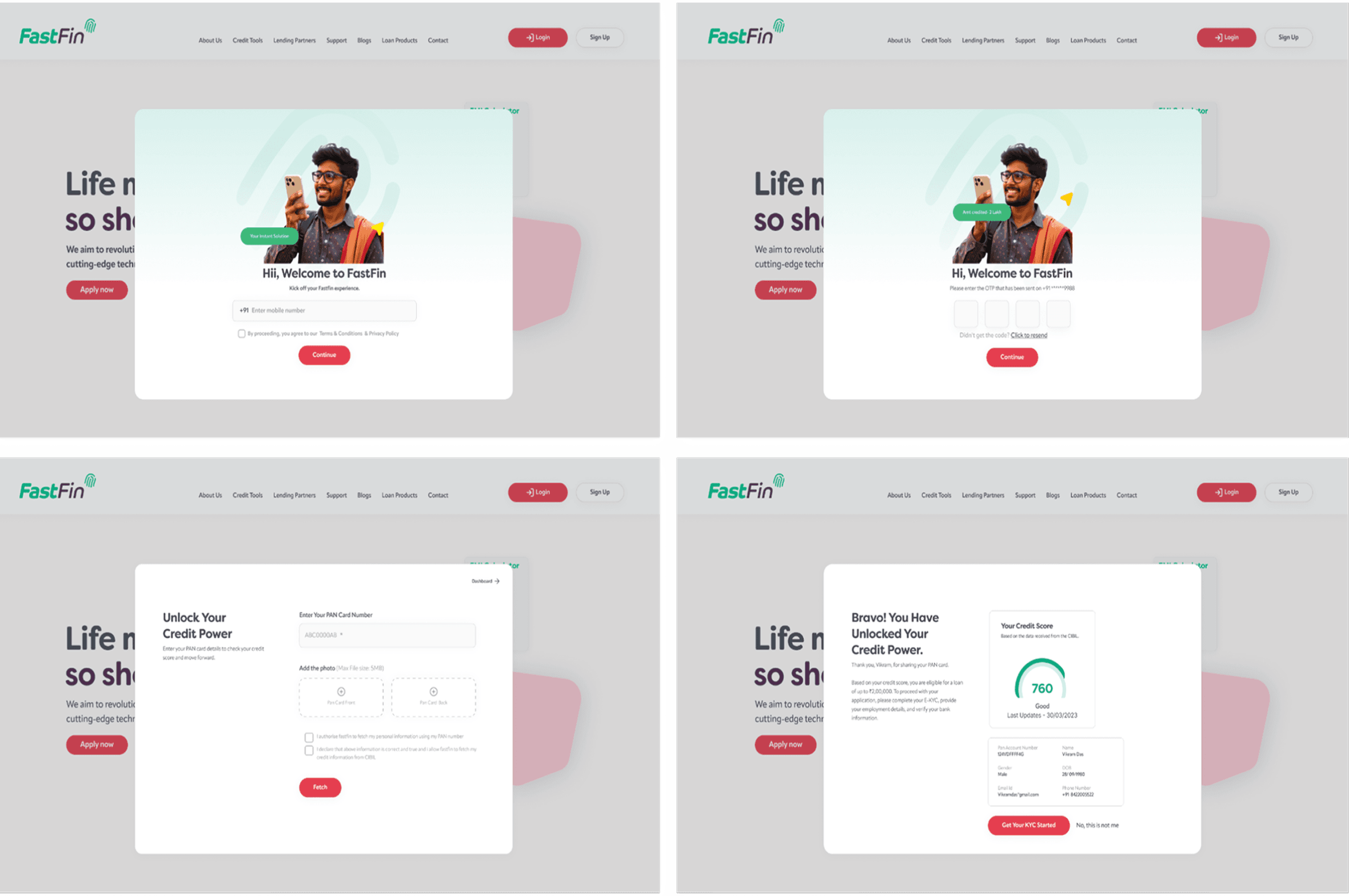

Capturing the users mobile number and log in through OTP.

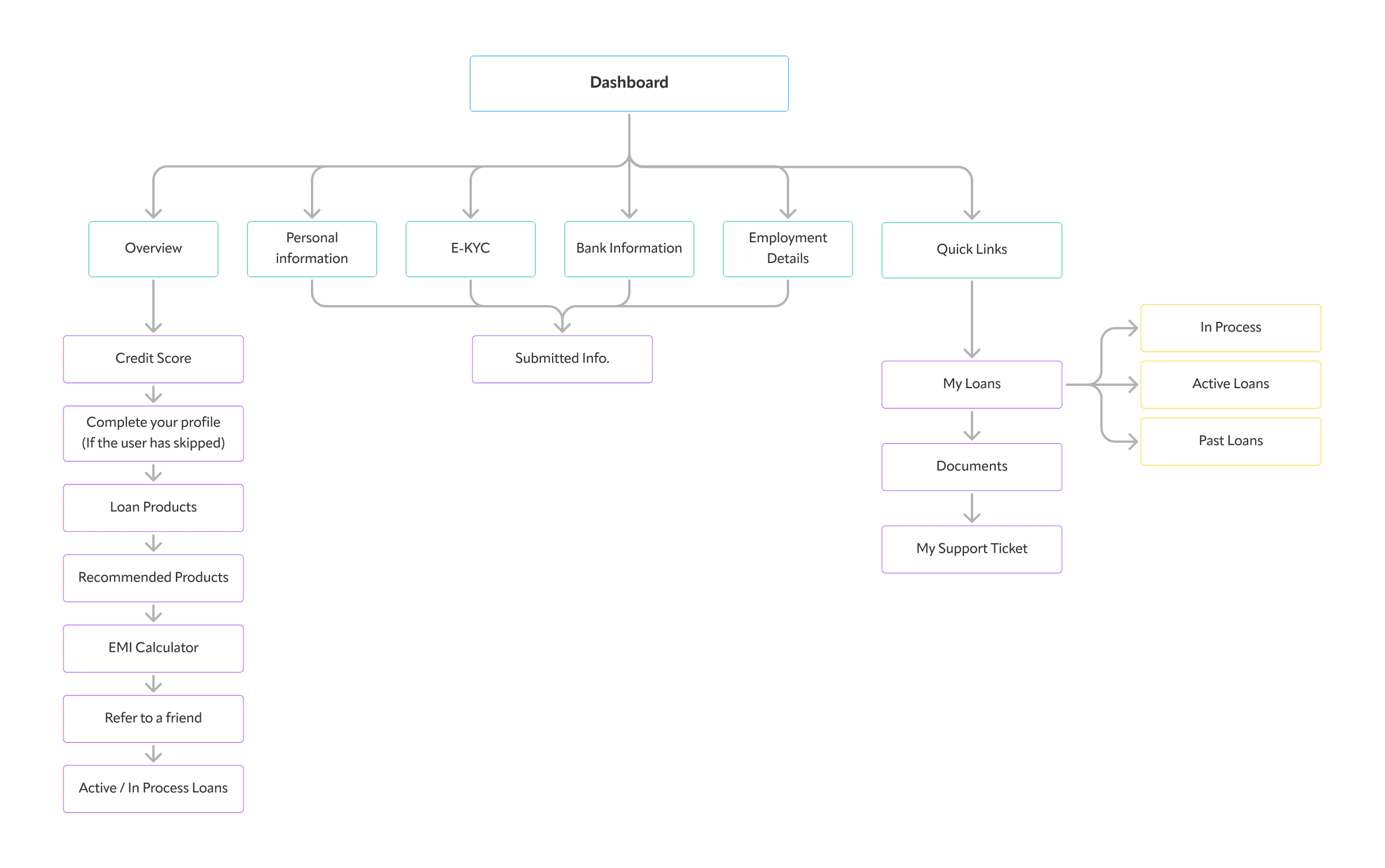

Once the user has logged in with the mobile number, they can skip to the Dashboard to experience the service for themselves.

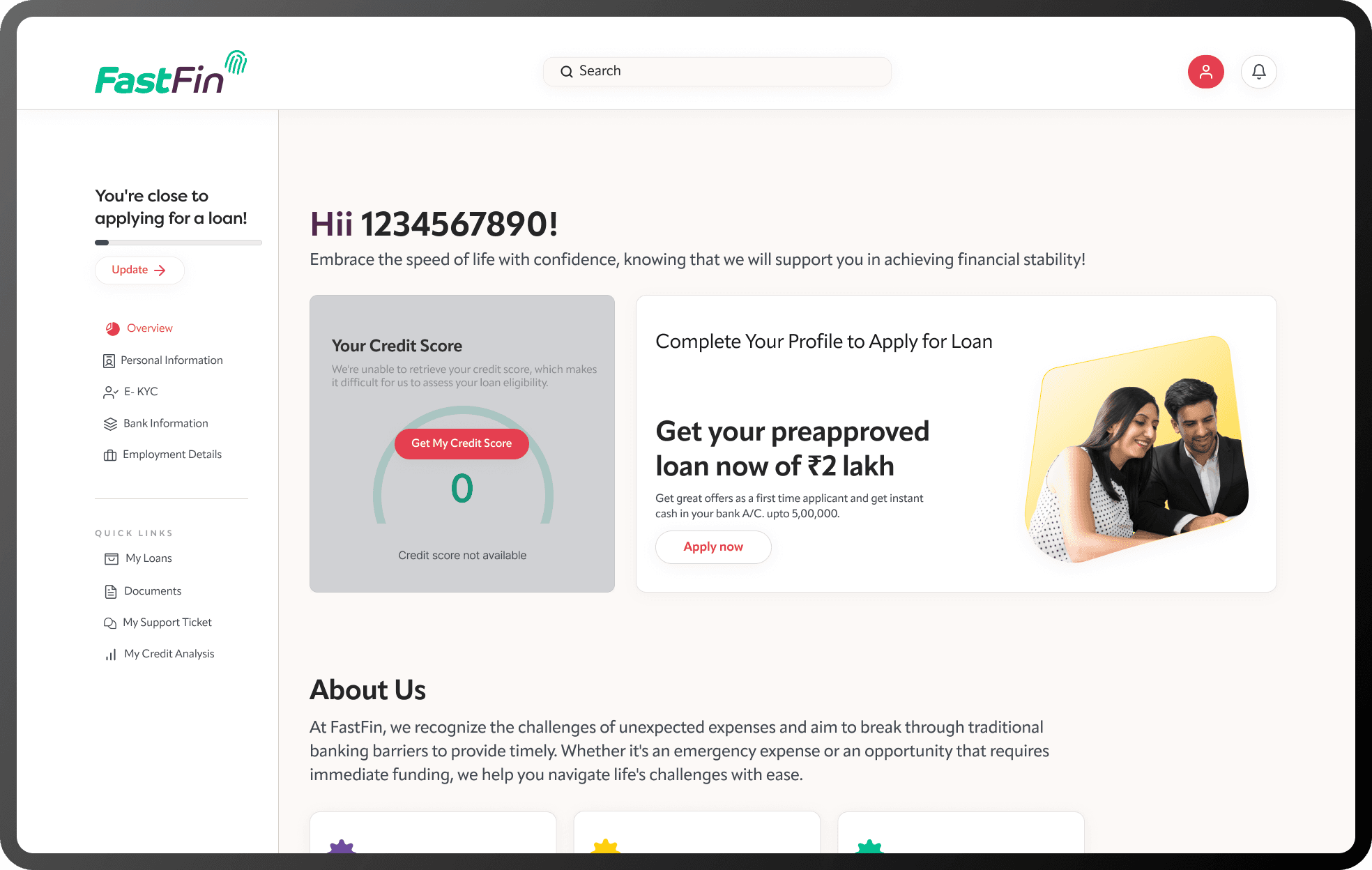

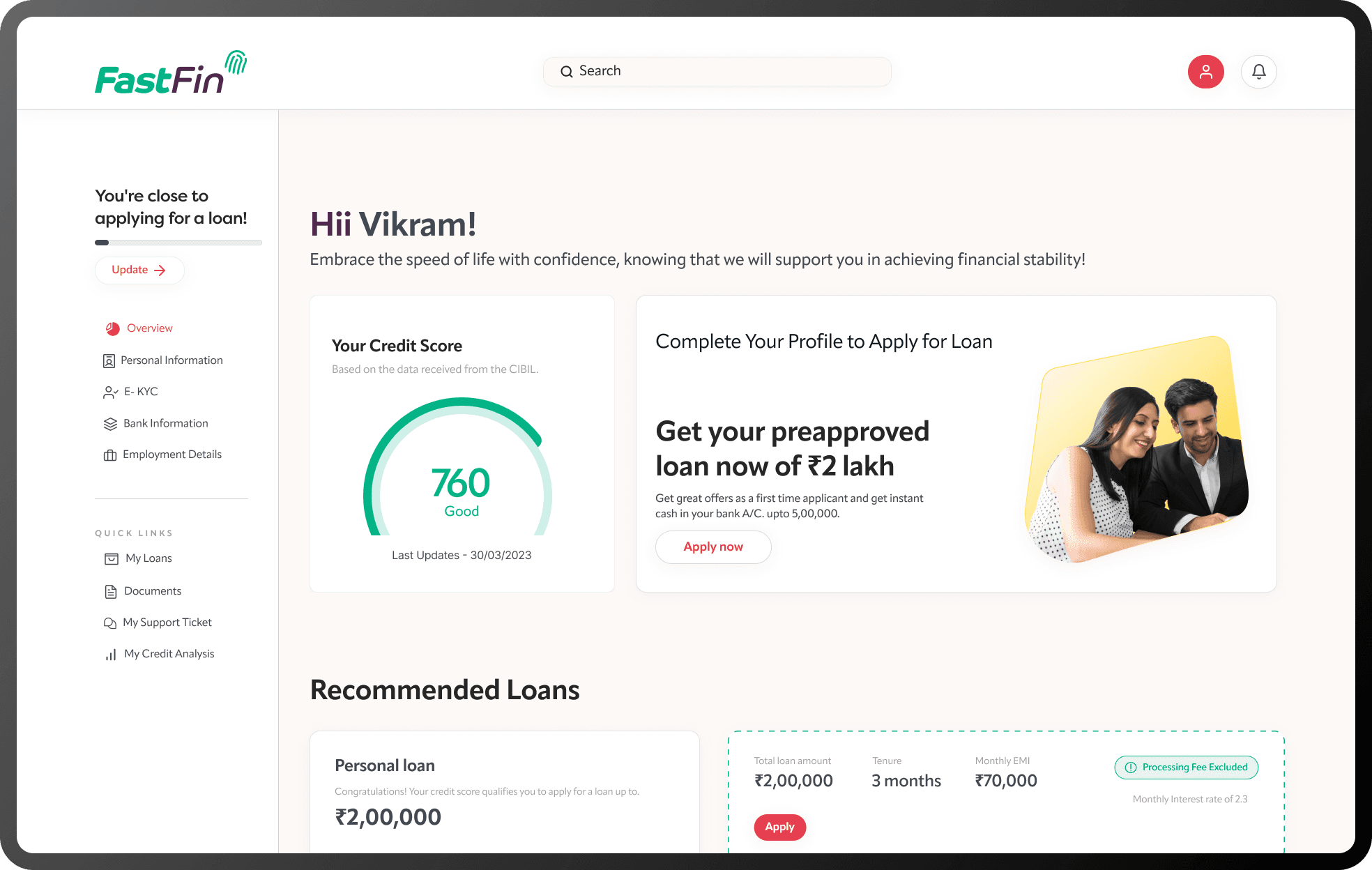

The user can access their credit score immediately which indicate them to take a loan which can significantly enhance the user's decision-making process.

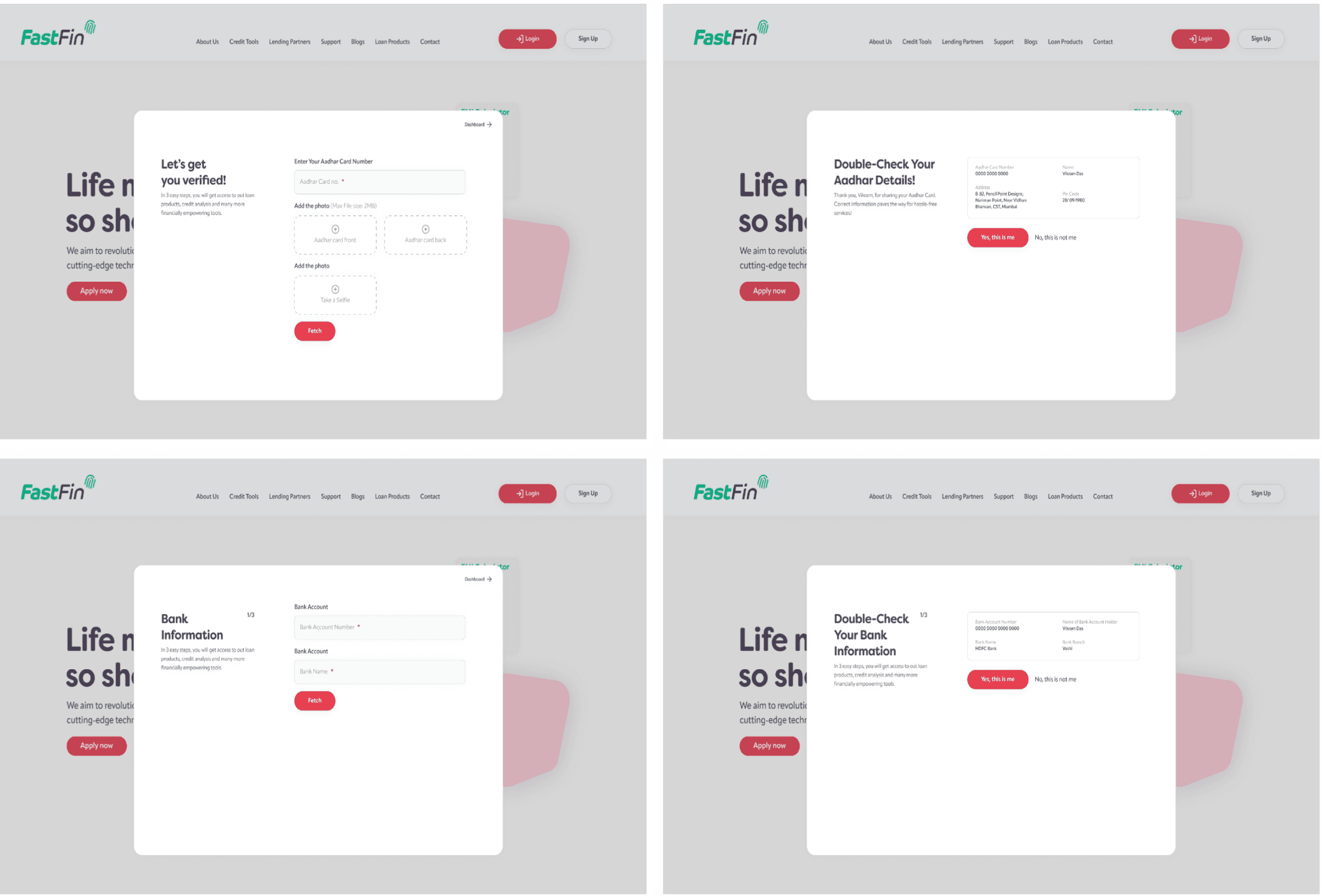

it’s crucial to implement a 'recheck' or 'confirmation' step where users can review their entries before final submission.

This approach emphasizes not just error prevention but also user empowerment through verification steps and clear communication.

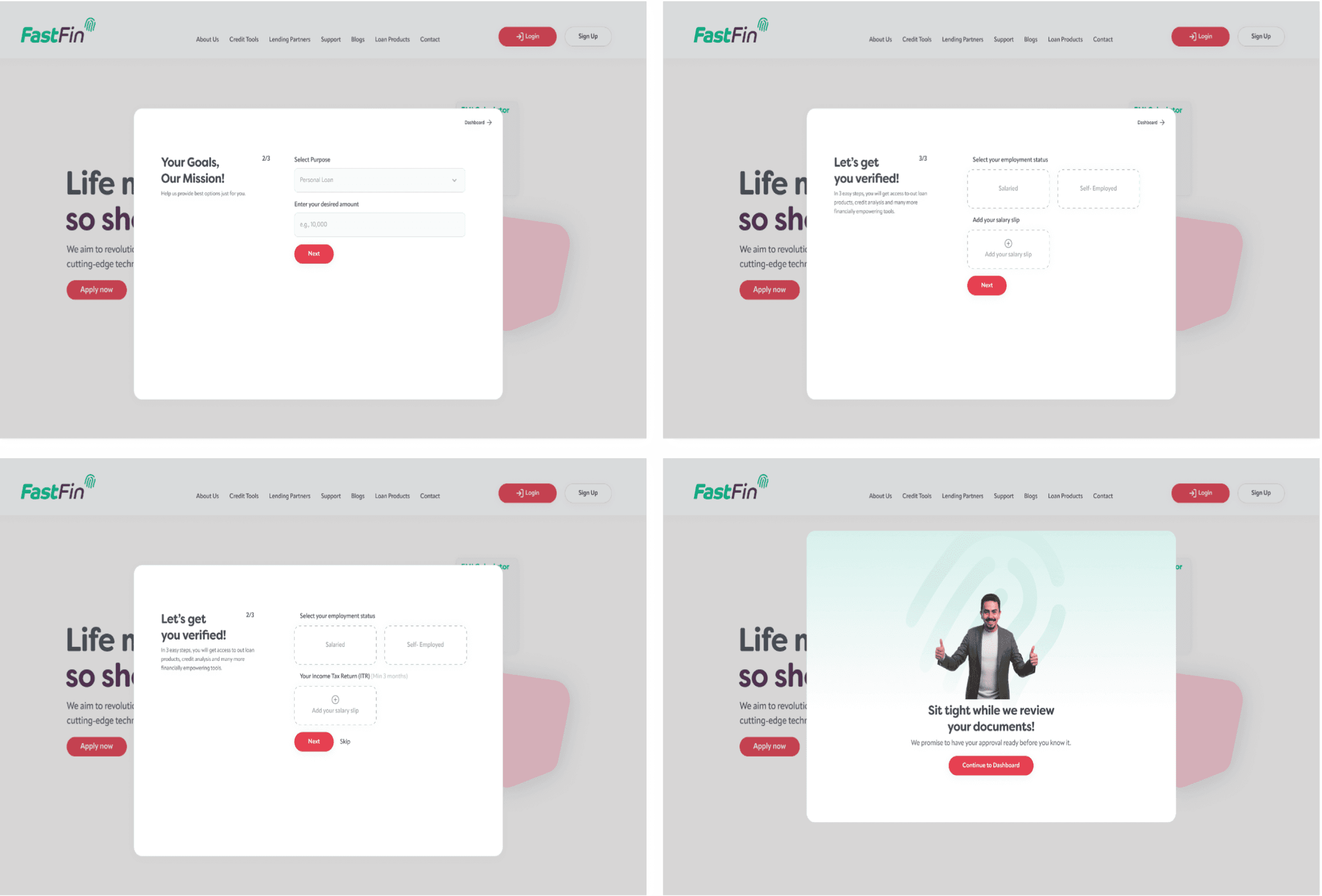

Final Stage

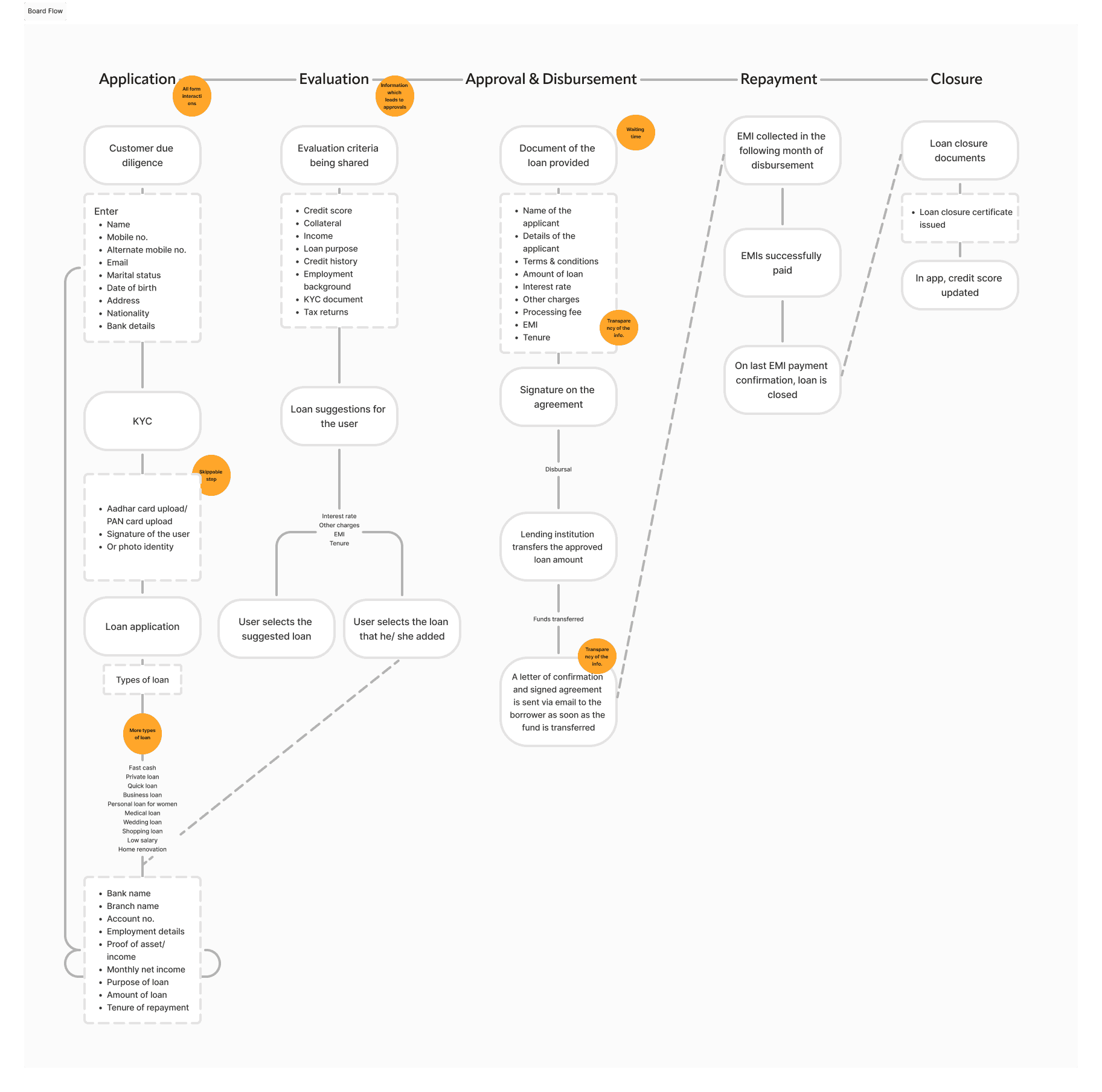

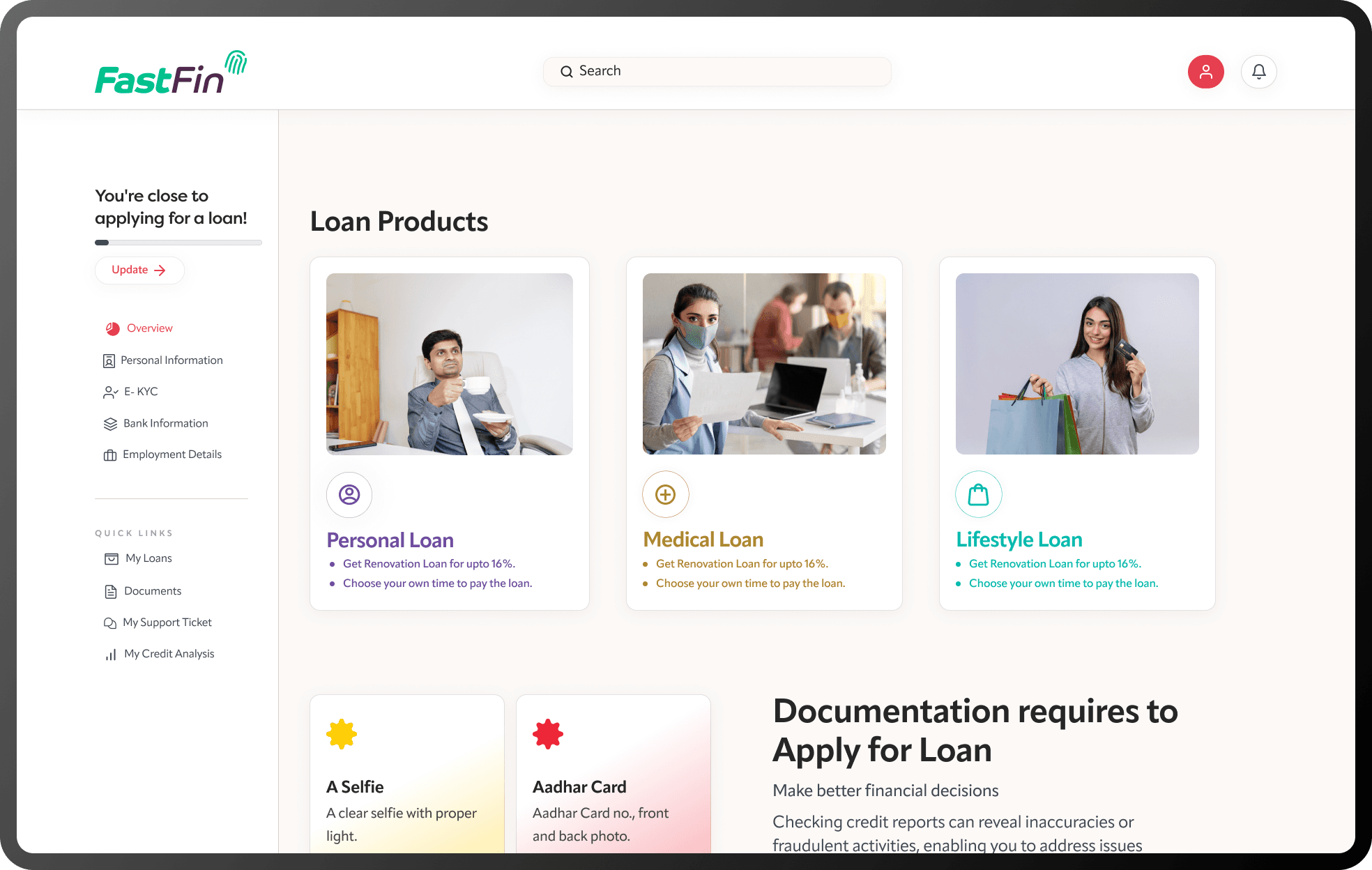

When users are prompted to specify the purpose of the loan (e.g., home purchase, education, business, personal use).

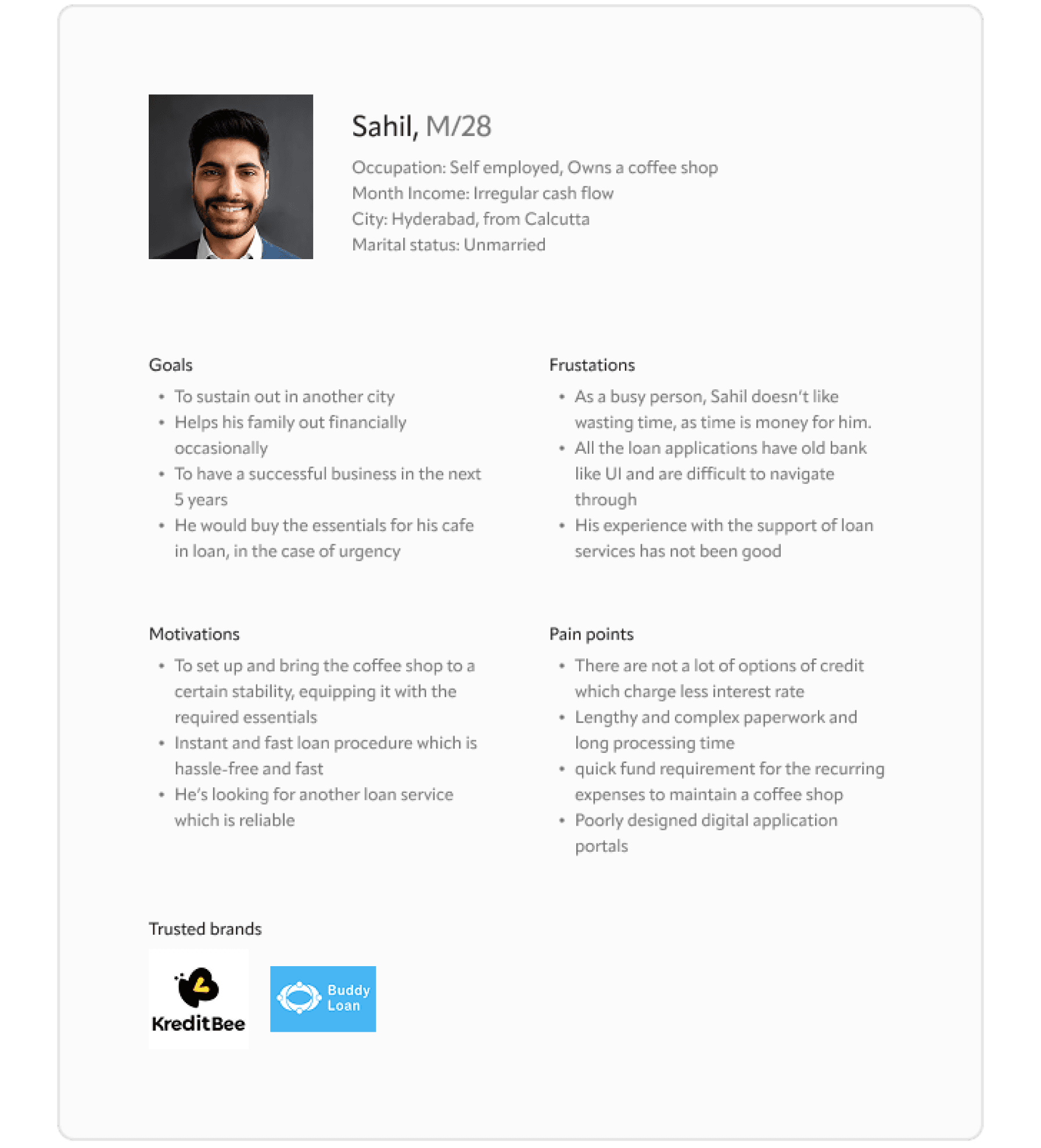

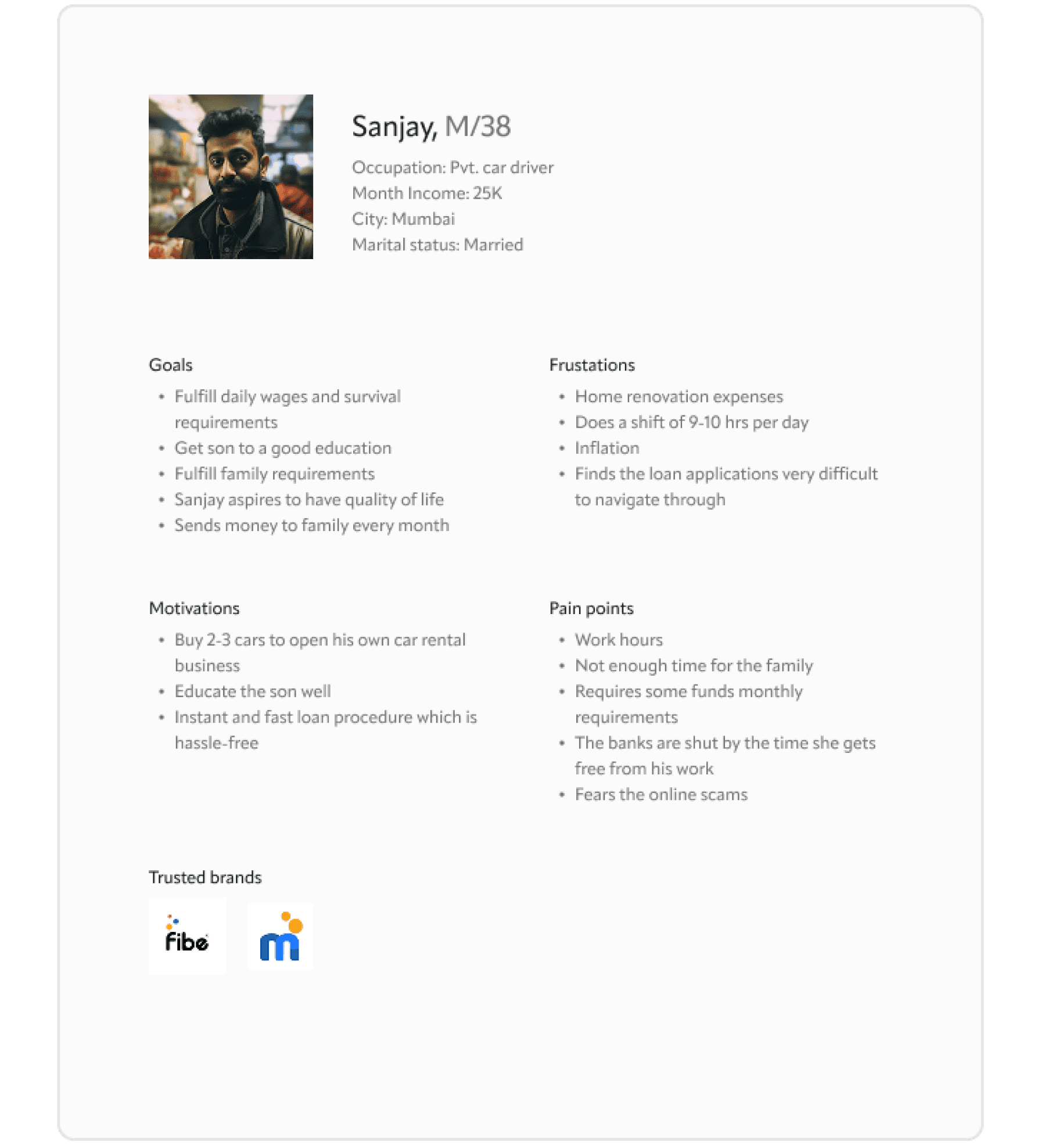

It's important for the UX design to cater to the diverse user base, distinguishing between salaried individuals and those who are self-employed.

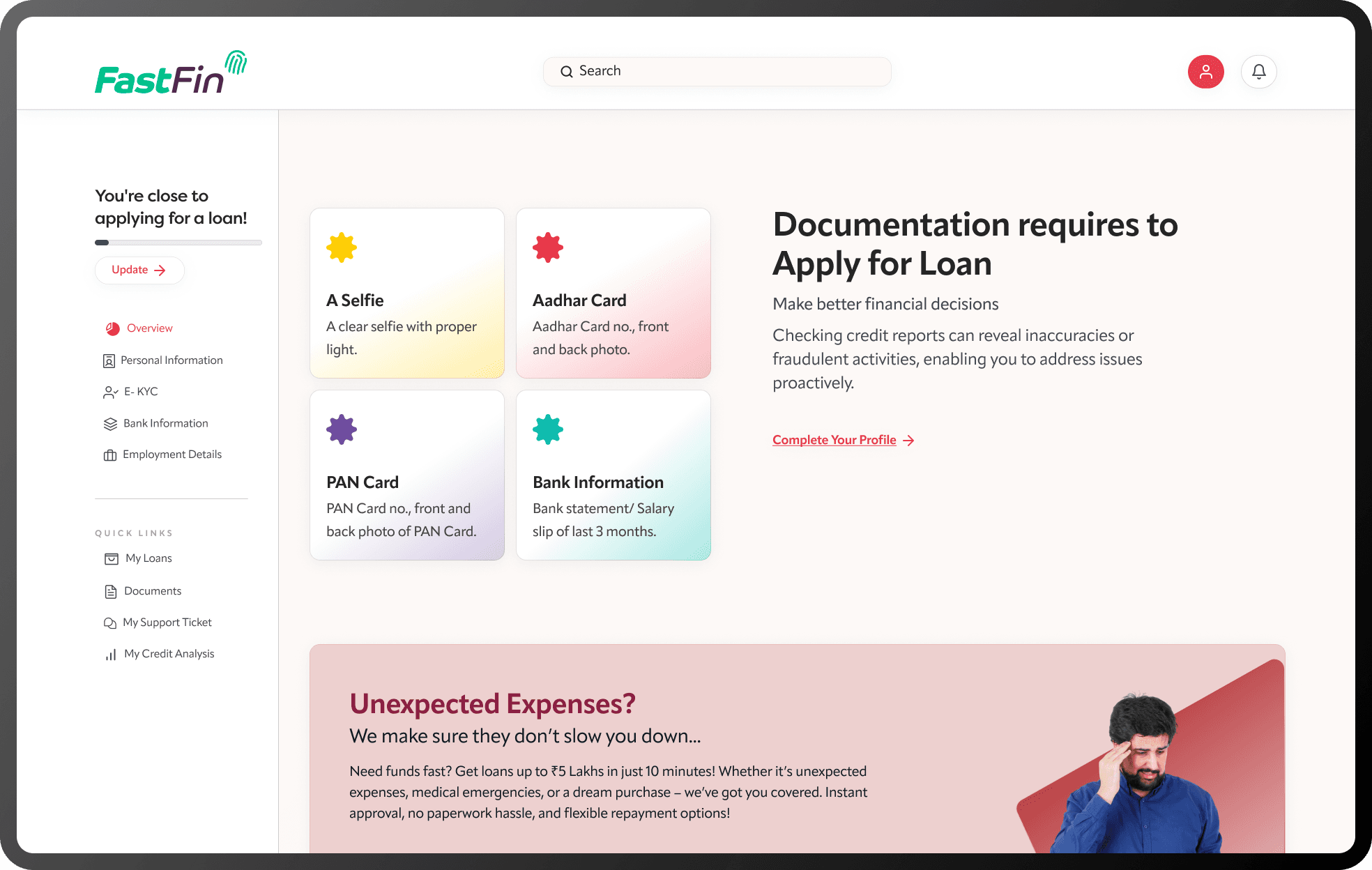

When the user has put in PAN and Aadhar information.

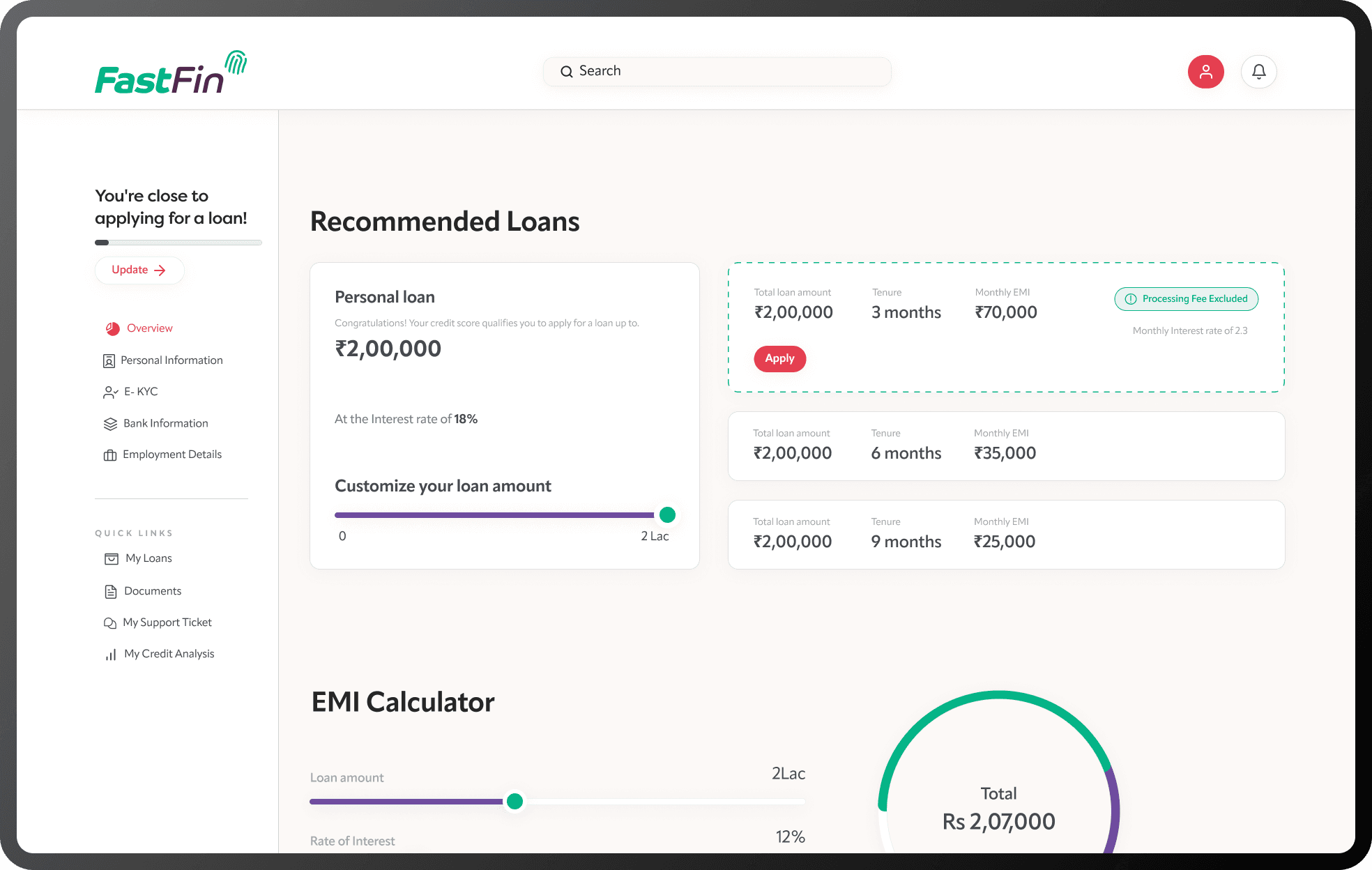

The credit score will be displayed with the “Recommended Loan” section.

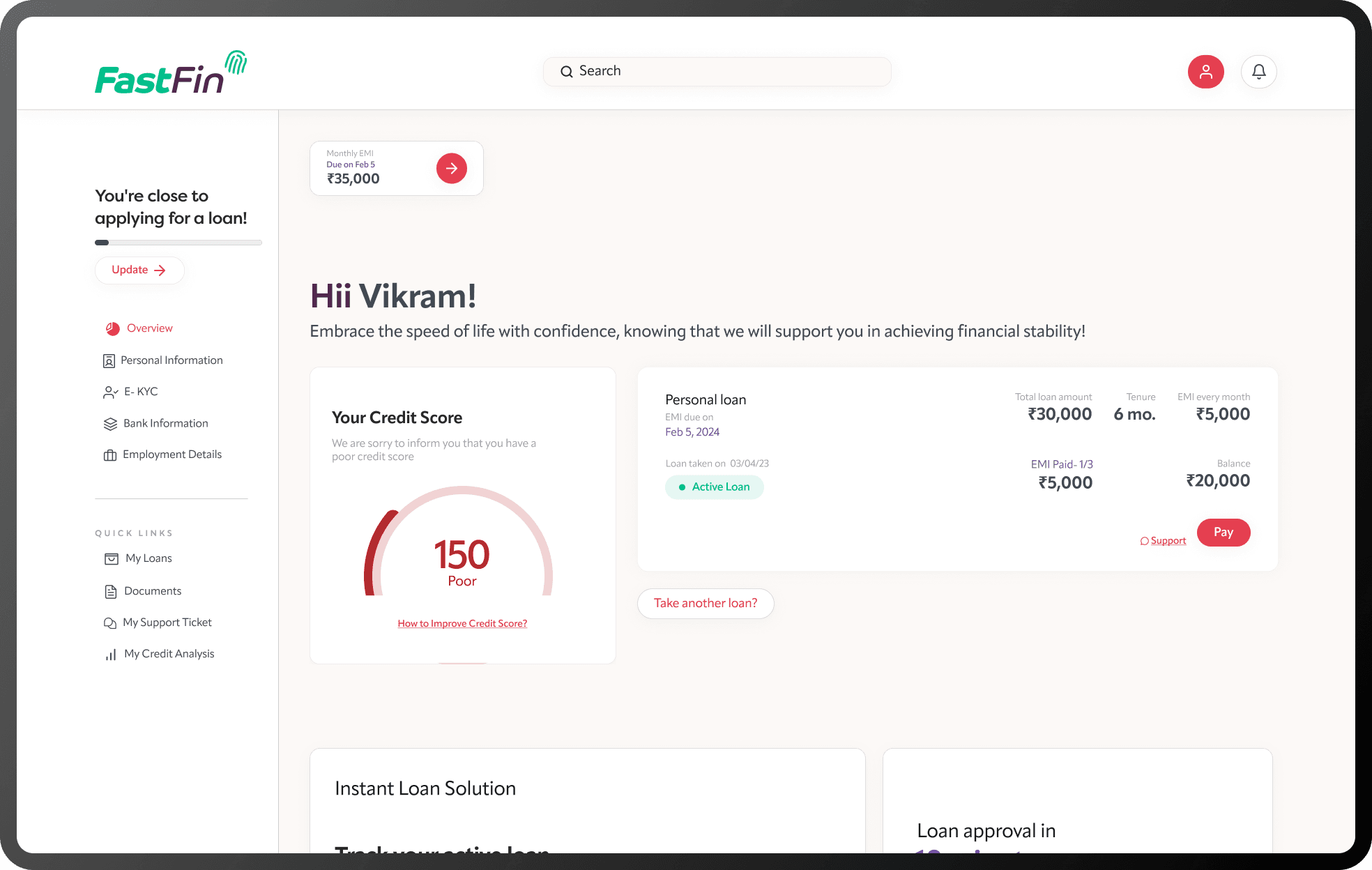

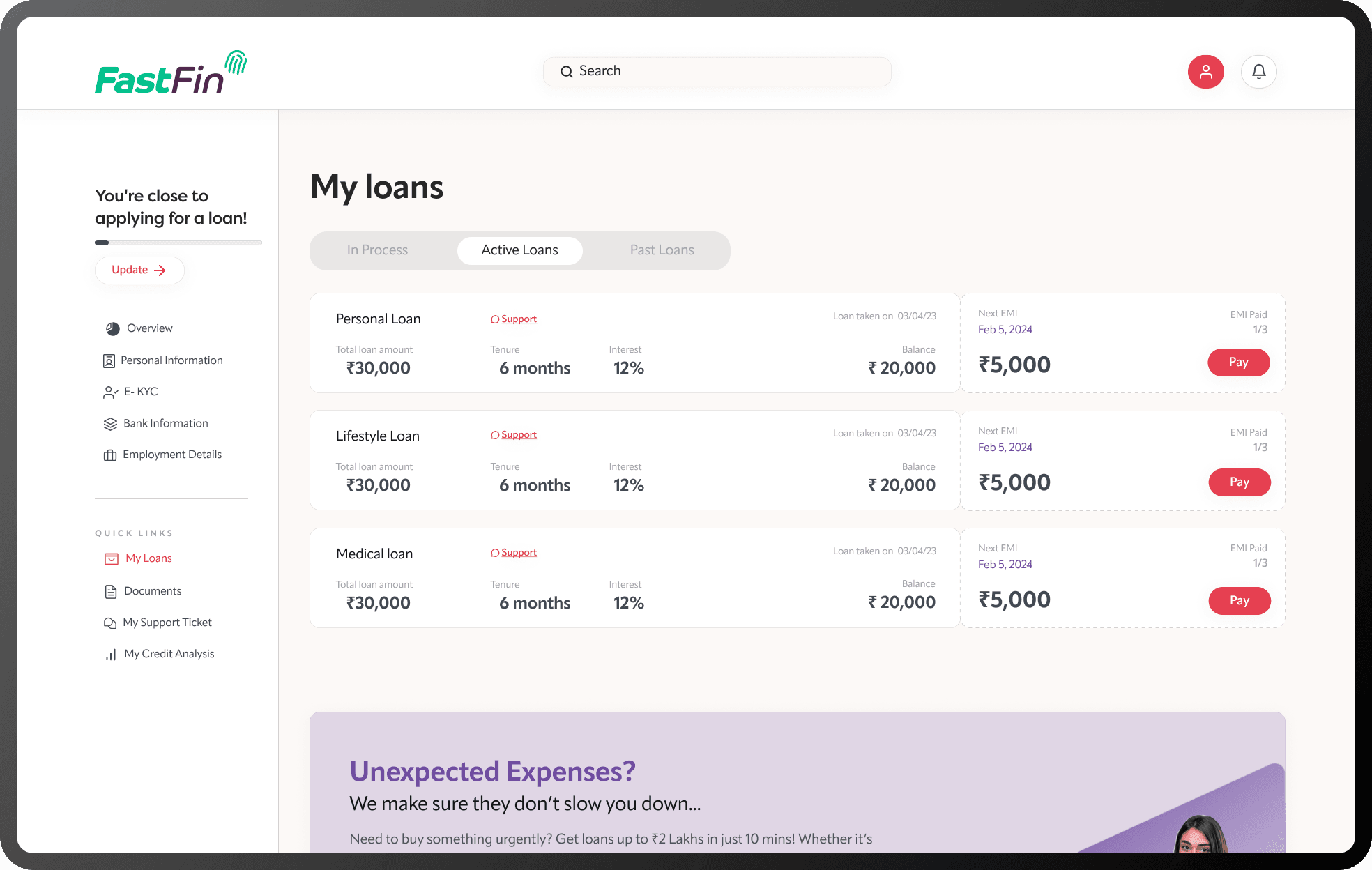

Active State

Loan disbursed and currently being repaid who may have ongoing EMIs. And the reflexion on their credit score.

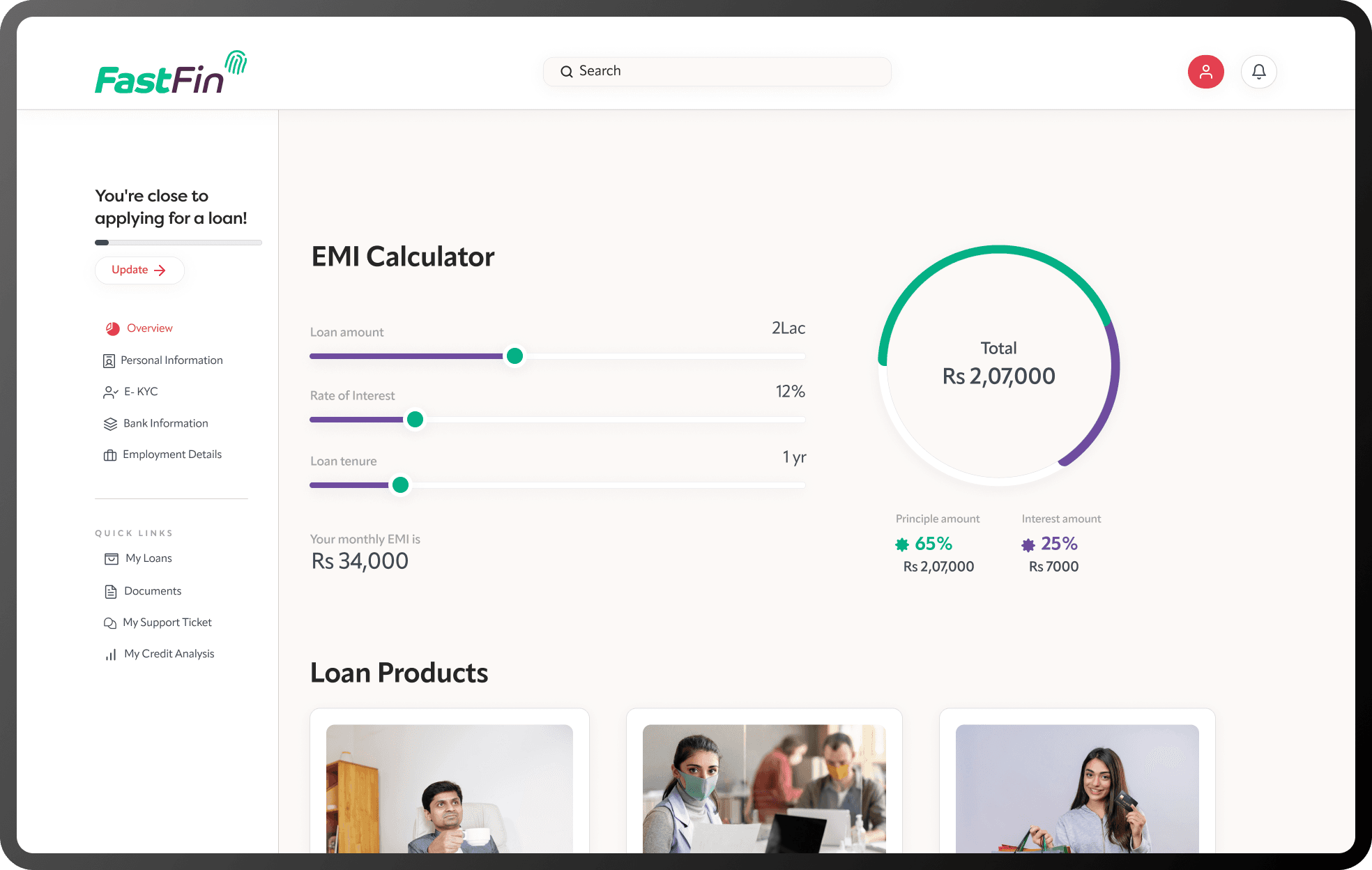

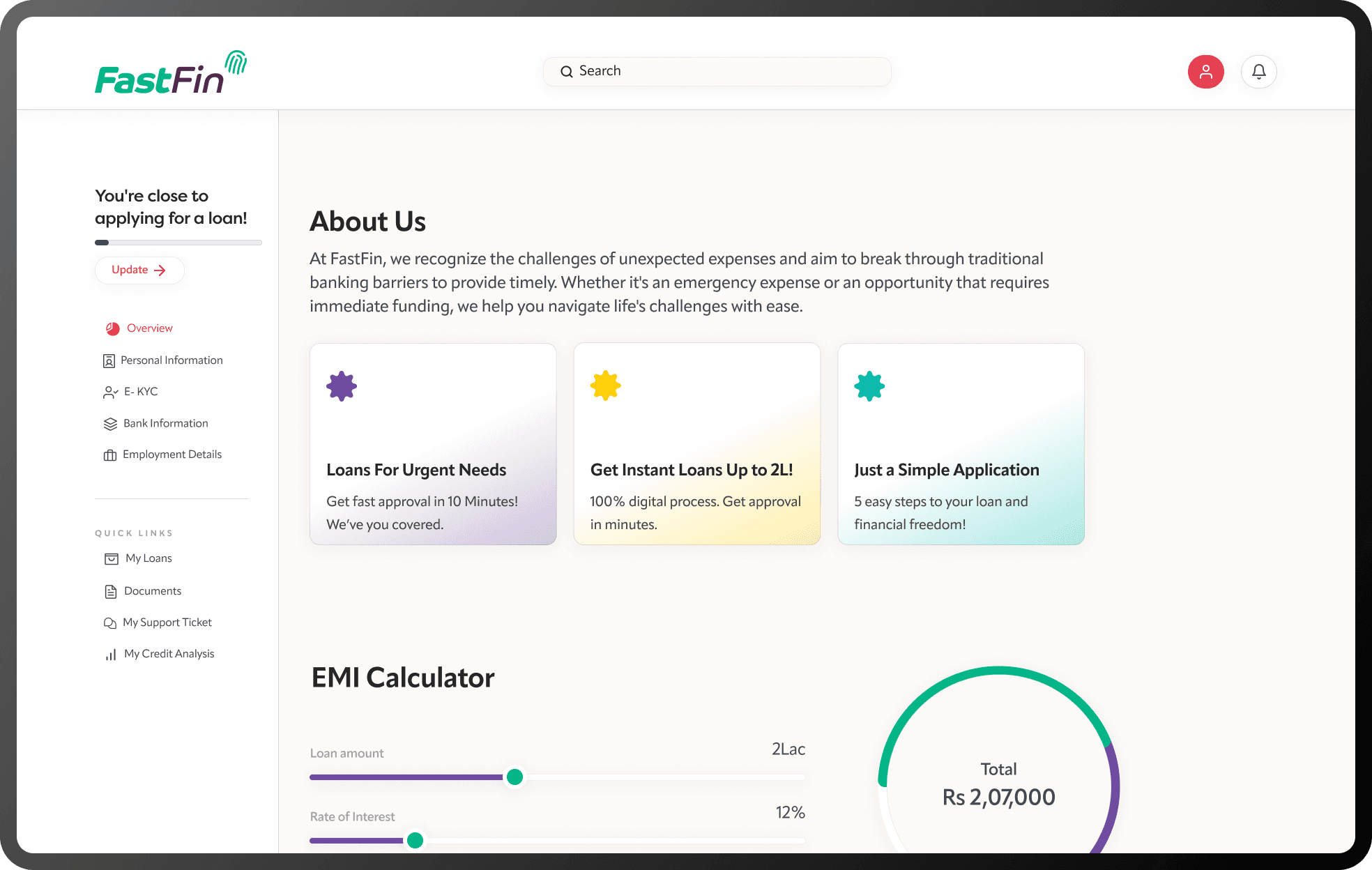

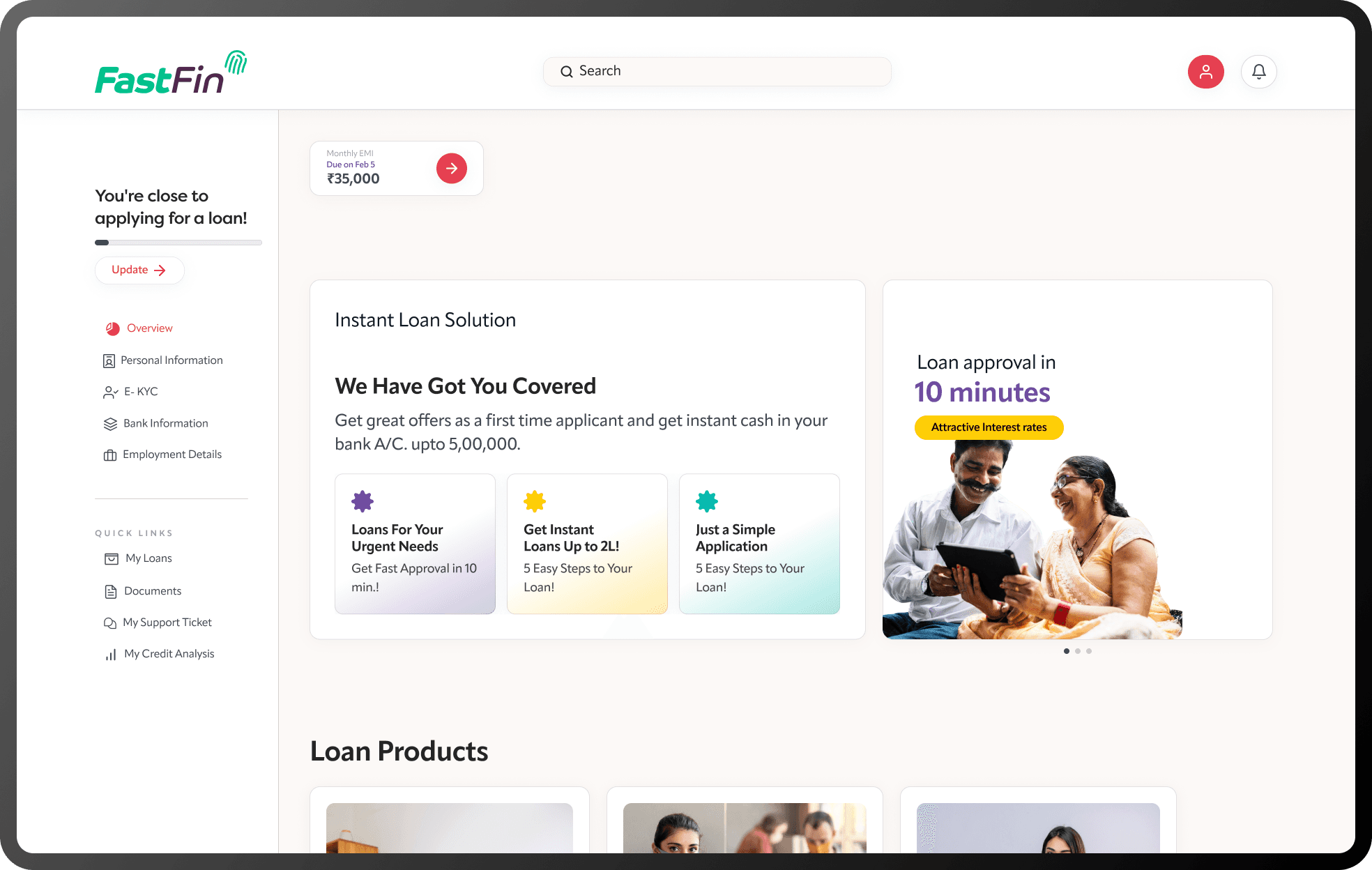

Access to EMI Calculator

and Loan Products.

A brief on docs which will be required.

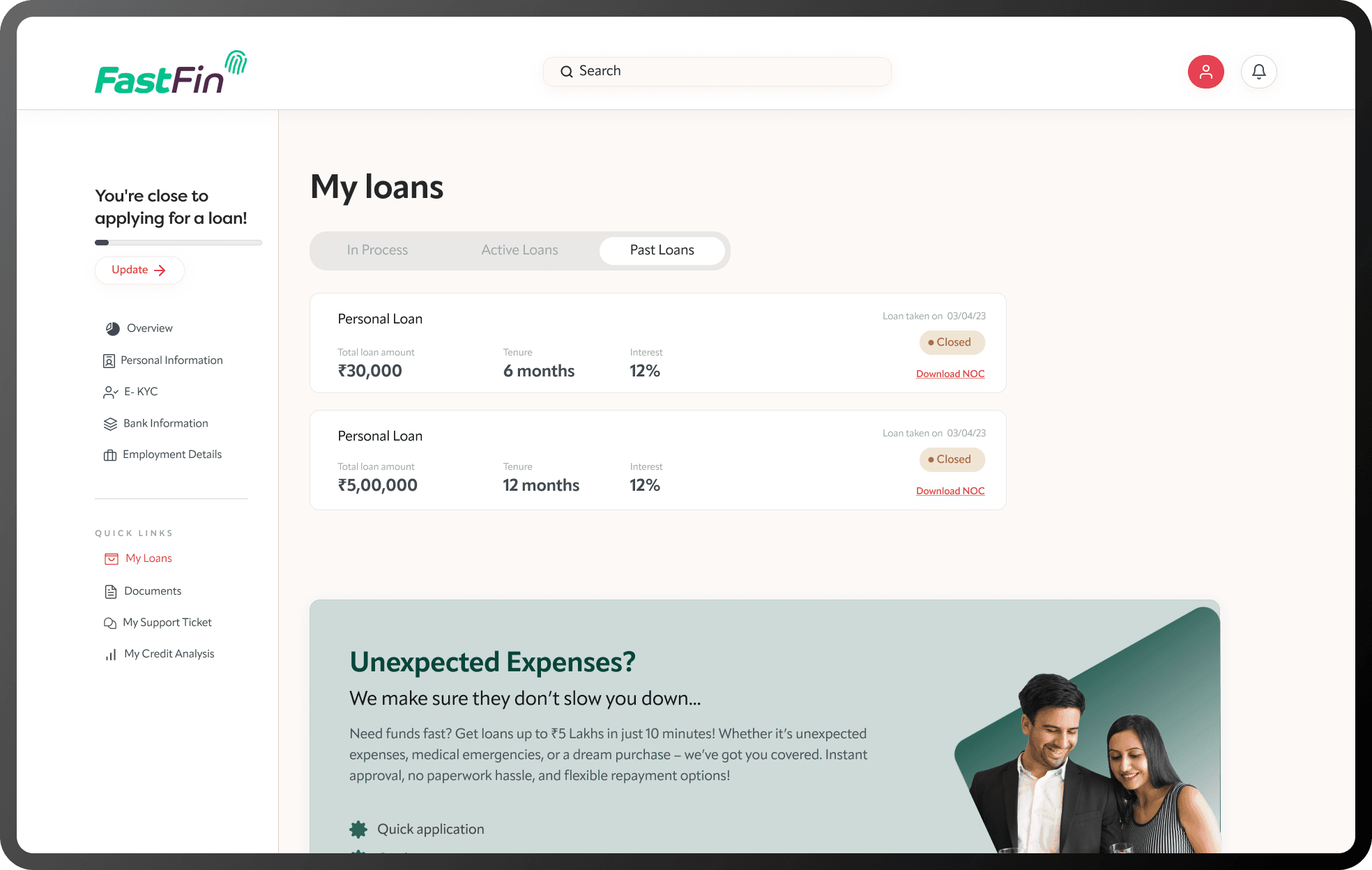

Loans taken and past loans summary in “My Loans” section.

Access to credit score would require finishing the onboarding process.

FastFin provides a streamlined, fast loan application process to help individuals and businesses access funds quickly.

It recognises the challenges of unexpected expenses and aim to break through traditional banking barriers to provide timely. Whether it's an emergency expense or an opportunity that requires immediate funding, it helps to navigate life's challenges with ease.

FastFin aims to help individuals or businesses with unexpected expenses, whether they're for emergencies or immediate opportunities.